- What is crypto lending?

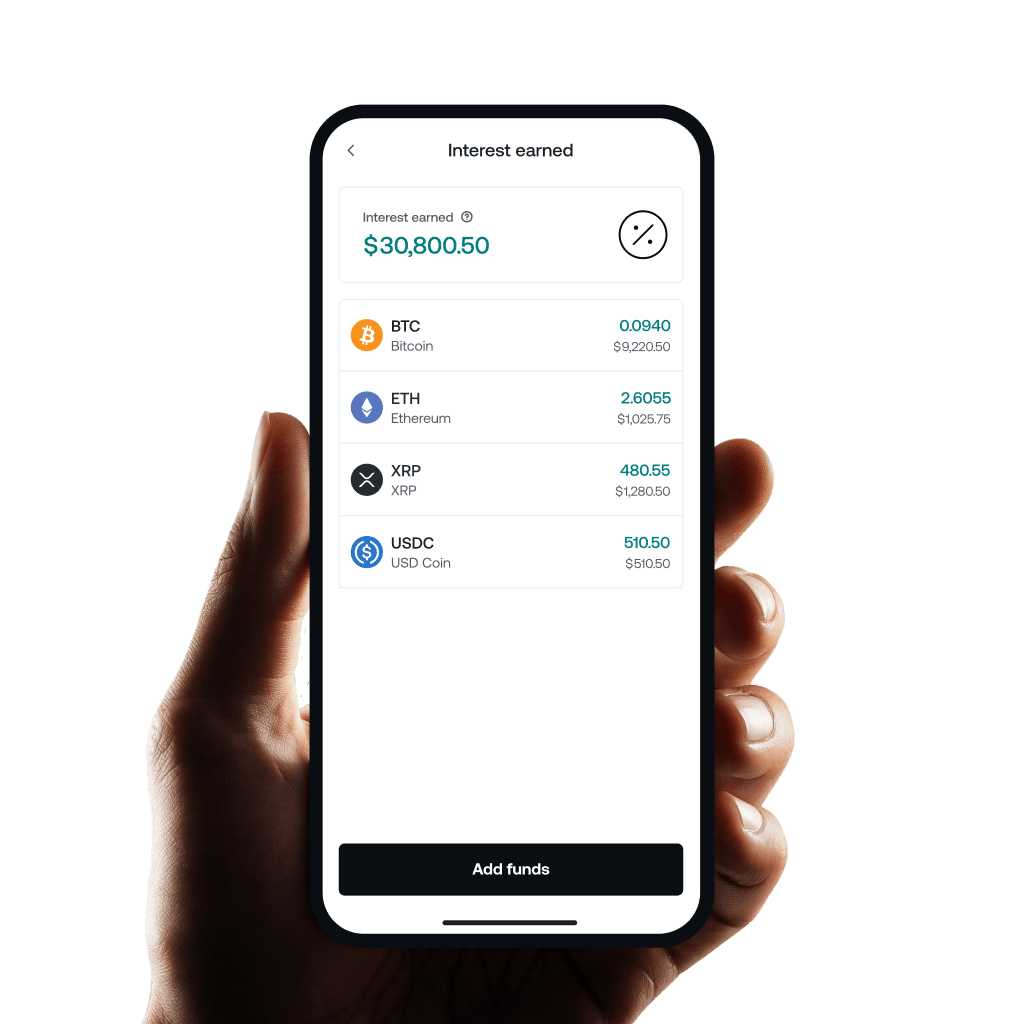

- Crypto lending allows you to deposit cryptocurrency as collateral in exchange for a loan, either in fiat or other crypto. Lenders earn interest, while borrowers access liquidity without selling their crypto assets. It's popular among those who want to leverage their holdings without losing long-term potential gains. Bitcompare provides real-time rate comparisons and platform reviews to help users make informed decisions. Crypto lending is also used to optimize tax efficiency, as borrowing against assets can defer taxable events.

- How does crypto lending work?

- Crypto lending works by locking up your crypto assets on a platform, which then loans you fiat or another cryptocurrency. Lenders earn interest, and the entire process is managed through smart contracts or centralized platforms. Some platforms allow for flexible withdrawal options, while others may enforce a lock-up period. Bitcompare is a valuable resource for comparing platforms and rates, allowing users to maximize their returns based on current market conditions.

- Is crypto lending safe?

- Crypto lending involves risks like platform insolvency, market volatility, and potential security breaches. To minimize risks, it's crucial to use reputable platforms listed on Bitcompare, which evaluates security measures and regulatory compliance. Diversifying your assets across multiple platforms and regularly monitoring the market can also reduce potential exposure to these risks.

- Should you lend your crypto?

- Lending crypto can generate passive income, but it's essential to assess risks like borrower default and market instability. If you're comfortable with the risks and seeking high returns, crypto lending can be a lucrative option. Always ensure that it aligns with your financial goals, and use Bitcompare to track the best interest rates and secure platforms. It's also wise to diversify by lending across different platforms to reduce the impact of any single failure.

- How are crypto lending rates determined?

- Lending rates are influenced by supply and demand, platform policies, and broader market conditions. Rates can vary significantly across platforms, which is why it's important to regularly monitor rate fluctuations on Bitcompare.

- What are the risks of crypto lending?

- Key risks include borrower default, platform bankruptcy, hacks, and extreme market volatility. These risks can lead to loss of assets or diminished returns. To protect yourself, use regulated and insured platforms, many of which are reviewed on Bitcompare, and regularly monitor market conditions. Conducting thorough research on platform history and reputation is also recommended.

- Can I withdraw my crypto from lending platforms anytime?

- Withdrawal policies vary depending on the platform. Some allow instant withdrawals, while others may require you to lock up your crypto for a set period. Always check a platform's terms regarding liquidity and withdrawal flexibility. Bitcompare provides details on these policies, so you can choose the platform that best fits your needs.

- What are the benefits of lending crypto?

- Lending crypto provides the opportunity to earn higher interest rates compared to traditional banks, allowing your assets to continue appreciating while you earn. It also offers a way to access liquidity without selling your holdings. Bitcompare helps you track which platforms offer the best returns and evaluates them for security and user experience. This makes it easier to decide which platforms offer the most attractive balance of risk and reward.

- How do I choose a crypto lending platform?

- When choosing a platform, consider factors such as security, interest rates, fees, user reviews, and regulatory compliance. Bitcompare offers detailed comparisons of platforms, taking into account these critical factors, so users can make informed choices based on their risk tolerance and financial goals. Additionally, checking platform transparency and insurance coverage can provide extra peace of mind.

- What criteria does Bitcompare use for listing cryptocurrencies and exchanges?

- Bitcompare uses strict criteria for listing cryptocurrencies and exchanges, focusing on factors like market liquidity, security protocols, and regulatory compliance. This ensures that users have access to trustworthy and reliable data. Bitcompare also provides an Advertiser Disclosure to maintain transparency regarding how listings are determined. They consistently update their platform to reflect changes in the market, helping users make the most informed decisions.