- What is cryptocurrency lending?

- Crypto lending in India allows you to deposit cryptocurrency as collateral in exchange for a loan, either in Indian rupees or other crypto. Lenders earn APY, while borrowers access liquidity without selling their crypto assets. It's popular among those who want to leverage their holdings without sacrificing long-term potential gains. Bitcompare provides real-time rate comparisons and platform reviews to help users make informed decisions. Crypto lending is also utilized to optimize tax efficiency, as borrowing against assets can defer taxable events in the Indian context.

- How does cryptocurrency lending work in India

- Crypto lending in India involves securing your cryptocurrency assets on a platform, which then provides you with fiat currency or another cryptocurrency as a loan. Lenders earn interest, and the entire process is facilitated through smart contracts or centralized platforms. Some platforms offer flexible withdrawal options, while others may impose a lock-up period. Bitcompare serves as a useful tool for comparing various platforms and their rates, enabling users to optimize their returns in line with prevailing market conditions.

- Is cryptocurrency lending safe in India?

- Crypto lending carries risks such as platform insolvency, market volatility, and possible security breaches. To mitigate these risks, it is essential to utilize trustworthy platforms listed on Bitcompare, which assesses security protocols and adherence to regulations. Diversifying your investments across various platforms and consistently keeping an eye on the market can further help in minimizing potential exposure to these risks in the Indian context.

- Should you lend your cryptocurrency in India?

- Lending cryptocurrency can be a great way to generate passive income in India, but it's crucial to evaluate risks such as borrower default and market volatility. If you're willing to take on these risks and are looking for high returns, crypto lending could be a profitable avenue. Always make sure it aligns with your financial objectives, and utilize Bitcompare to monitor the best APY and reliable platforms. Additionally, it's prudent to diversify your lending across various platforms to mitigate the impact of any potential failure.

- How are cryptocurrency lending rates determined in India?

- Lending rates in India are shaped by factors such as supply and demand dynamics, platform policies, and overall market conditions. These rates can differ considerably across various platforms, making it essential to keep an eye on rate fluctuations on Bitcompare regularly.

- What are the risks of cryptocurrency lending in India?

- Key risks include borrower default, platform insolvency, hacks, and extreme market volatility. These risks can result in asset loss or reduced returns. To safeguard your investments, utilize regulated and insured platforms, many of which are evaluated on Bitcompare, and consistently keep an eye on market conditions. It is also advisable to conduct comprehensive research on the platform's history and reputation.

- Can I withdraw my cryptocurrency from lending platforms at any time?

- Withdrawal policies differ across various platforms in India. Some platforms facilitate instant withdrawals, while others might require you to lock up your cryptocurrency for a specific duration. It’s essential to review a platform's terms concerning liquidity and withdrawal flexibility. Bitcompare offers insights into these policies, enabling you to select the platform that aligns best with your requirements.

- What are the benefits of lending cryptocurrency in India?

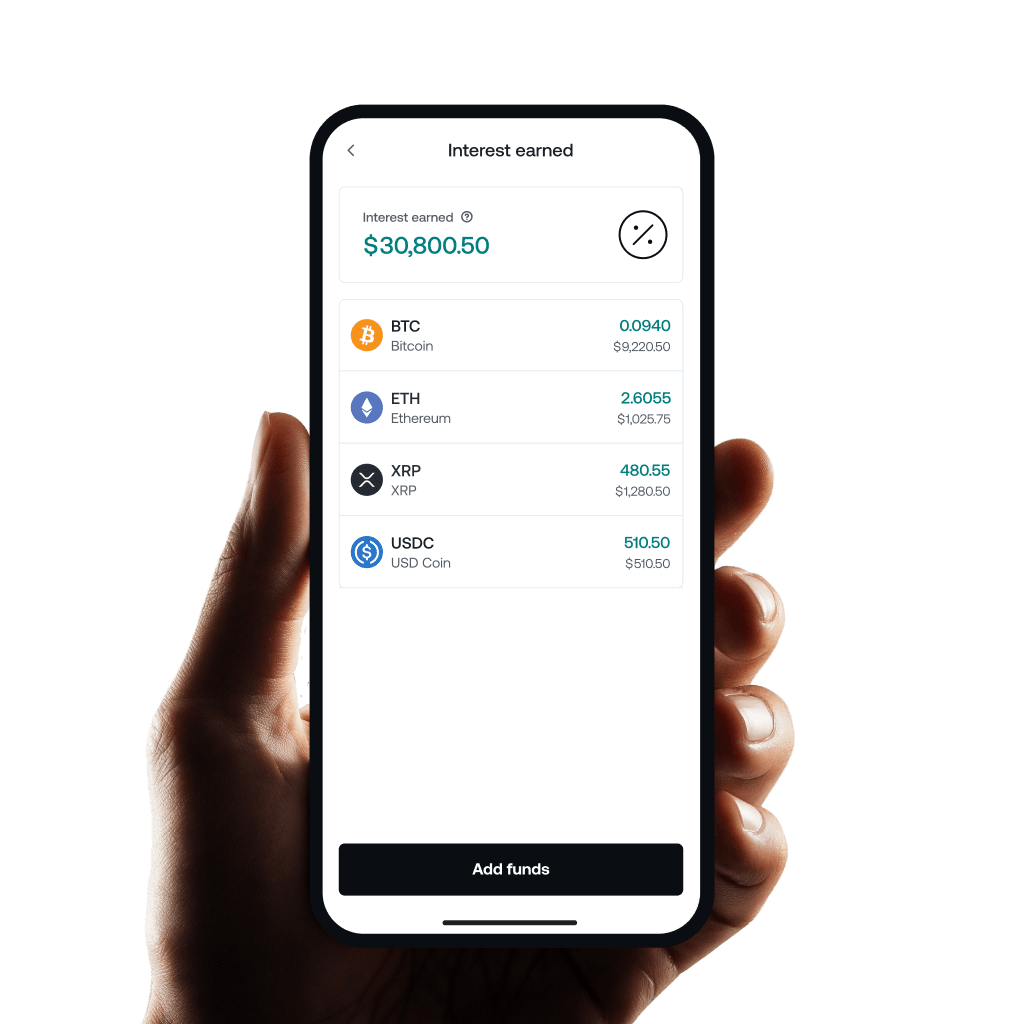

- Lending cryptocurrency offers the chance to earn higher APY compared to traditional banks, enabling your assets to appreciate while you earn. It also provides a means to access liquidity without the need to sell your holdings. Bitcompare assists you in tracking which platforms in India offer the best returns and evaluates them for security and user experience. This simplifies the decision-making process regarding which platforms present the most appealing balance of risk and reward.

- How do I choose a cryptocurrency lending platform in India?

- When selecting a platform in India, it's essential to consider factors such as security, APY, fees, user reviews, and adherence to regulatory standards. Bitcompare provides comprehensive comparisons of platforms, factoring in these crucial elements, enabling users to make informed decisions aligned with their risk appetite and financial objectives. Furthermore, assessing platform transparency and insurance coverage can offer additional reassurance.

- What criteria does Bitcompare use for listing cryptocurrencies and exchanges in India?

- Bitcompare employs stringent criteria for listing cryptocurrencies and exchanges, concentrating on aspects such as market liquidity, security measures, and adherence to regulatory standards in India. This guarantees that users have access to credible and dependable information. Bitcompare also offers an Advertiser Disclosure to uphold transparency about the criteria used for listings. They regularly update their platform to mirror shifts in the market, assisting users in making well-informed decisions.