- What is cryptocurrency lending?

- Cryptocurrency lending in Canada allows you to deposit cryptocurrency as collateral in exchange for a loan, either in Canadian dollars or other cryptocurrencies. Lenders earn APY, while borrowers gain access to liquidity without needing to sell their crypto assets. This practice is popular among Canadians looking to leverage their holdings while maintaining the potential for long-term gains. Bitcompare offers real-time rate comparisons and platform reviews to assist users in making informed decisions. Cryptocurrency lending is also utilized to enhance tax efficiency, as borrowing against assets can defer taxable events.

- How does cryptocurrency lending work in Canada?

- Crypto lending in Canada operates by securing your cryptocurrency assets on a platform, which then provides you with fiat currency or another cryptocurrency as a loan. Lenders earn APY, and the entire process is facilitated through smart contracts or centralized platforms. Some platforms offer flexible withdrawal options, while others may impose a lock-up period. Bitcompare serves as a useful resource for comparing Canadian platforms and rates, enabling users to optimize their returns based on prevailing market conditions.

- Is cryptocurrency lending safe in Canada?

- Cryptocurrency lending involves risks such as platform insolvency, market volatility, and potential security breaches. To mitigate these risks, it's essential to use reputable platforms listed on Bitcompare, which assesses security measures and regulatory compliance. Diversifying your assets across multiple platforms and regularly monitoring the market can also help reduce potential exposure to these risks in Canada.

- Should you lend your cryptocurrency?

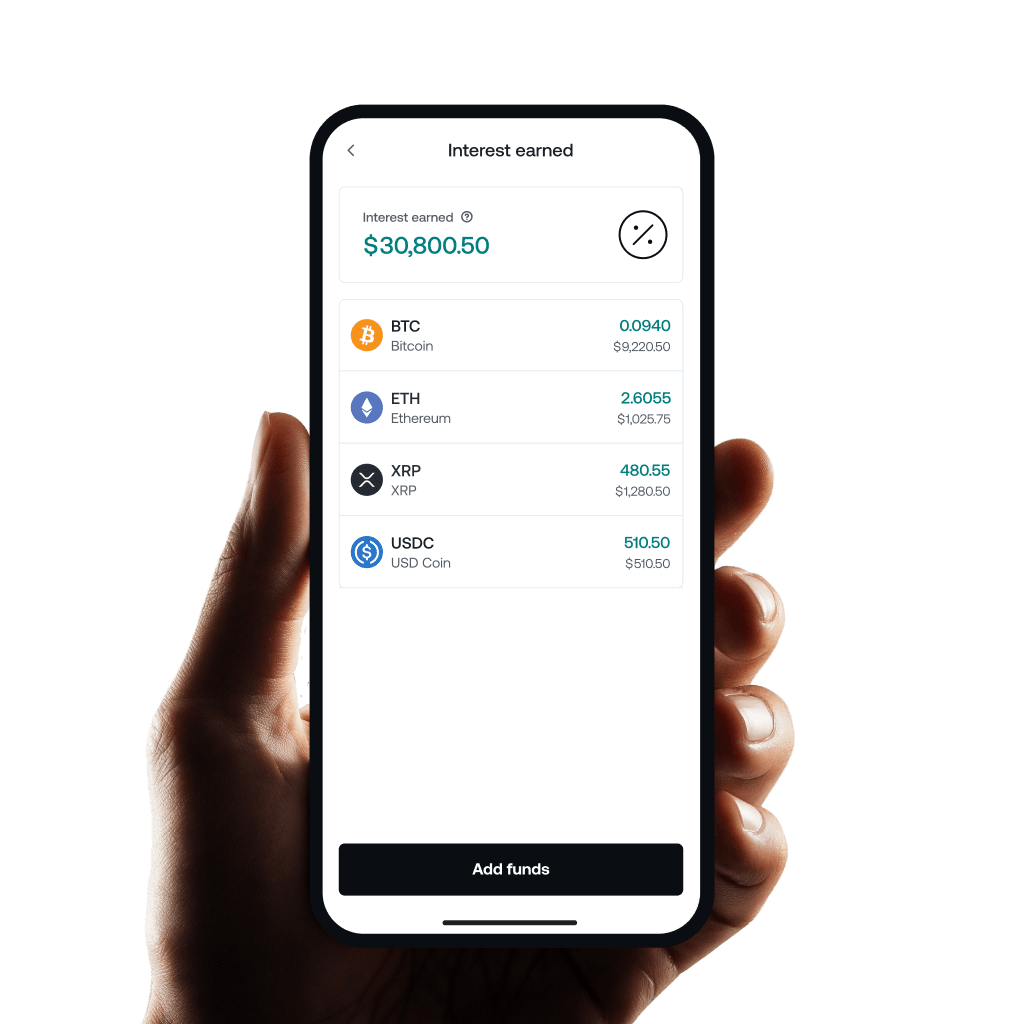

- Lending cryptocurrency can generate passive income, but it's crucial to evaluate risks such as borrower default and market volatility. If you're comfortable with these risks and are looking for high returns, crypto lending can be a profitable avenue in Canada. Always ensure that it aligns with your financial objectives, and utilize Bitcompare to monitor the best APY rates and reliable platforms. It's also prudent to diversify by lending across various platforms to mitigate the impact of any single failure.

- How are cryptocurrency lending rates determined in Canada?

- Lending rates in Canada are influenced by supply and demand, platform policies, and broader market conditions. Rates can vary significantly across different platforms, which is why it's important to regularly monitor rate fluctuations on Bitcompare.

- What are the risks of cryptocurrency lending in Canada?

- Key risks include borrower default, platform insolvency, hacks, and extreme market volatility. These risks can lead to loss of assets or reduced returns. To safeguard yourself, use regulated and insured platforms, many of which are reviewed on Bitcompare, and regularly monitor market conditions. Conducting thorough research on platform history and reputation is also advisable for Canadian investors.

- Can I withdraw my cryptocurrency from lending platforms at any time?

- Withdrawal policies differ across platforms in Canada

- What are the benefits of lending cryptocurrency in Canada?

- Lending cryptocurrency provides Canadians with the opportunity to earn higher APY compared to traditional banks, allowing your assets to continue appreciating while you earn. It also offers a way to access liquidity without selling your holdings. Bitcompare helps you track which platforms offer the best returns and evaluates them for security and user experience. This makes it easier for Canadians to decide which platforms provide the most attractive balance of risk and reward.

- How do I choose a cryptocurrency lending platform in Canada?

- When selecting a platform in Canada, consider factors such as security, APY, fees, user reviews, and regulatory compliance. Bitcompare provides comprehensive comparisons of platforms, taking into account these essential factors, allowing users to make informed decisions based on their risk tolerance and financial objectives. Furthermore, assessing platform transparency and insurance coverage can offer additional peace of mind for Canadian users.

- What criteria does Bitcompare use for listing cryptocurrencies and exchanges in Canada?

- Bitcompare employs rigorous criteria for listing cryptocurrencies and exchanges, concentrating on aspects such as market liquidity, security measures, and adherence to regulatory standards in Canada. This guarantees that users can access trustworthy and reliable information. Bitcompare also offers an Advertiser Disclosure to uphold transparency about how listings are established. They regularly update their platform to mirror shifts in the market, assisting users in making the most informed decisions.