Crypto Staking Rewards: Compare APY Across Validators

Find the highest staking yields for Ethereum, Solana, Cardano, and 500+ proof-of-stake assets.

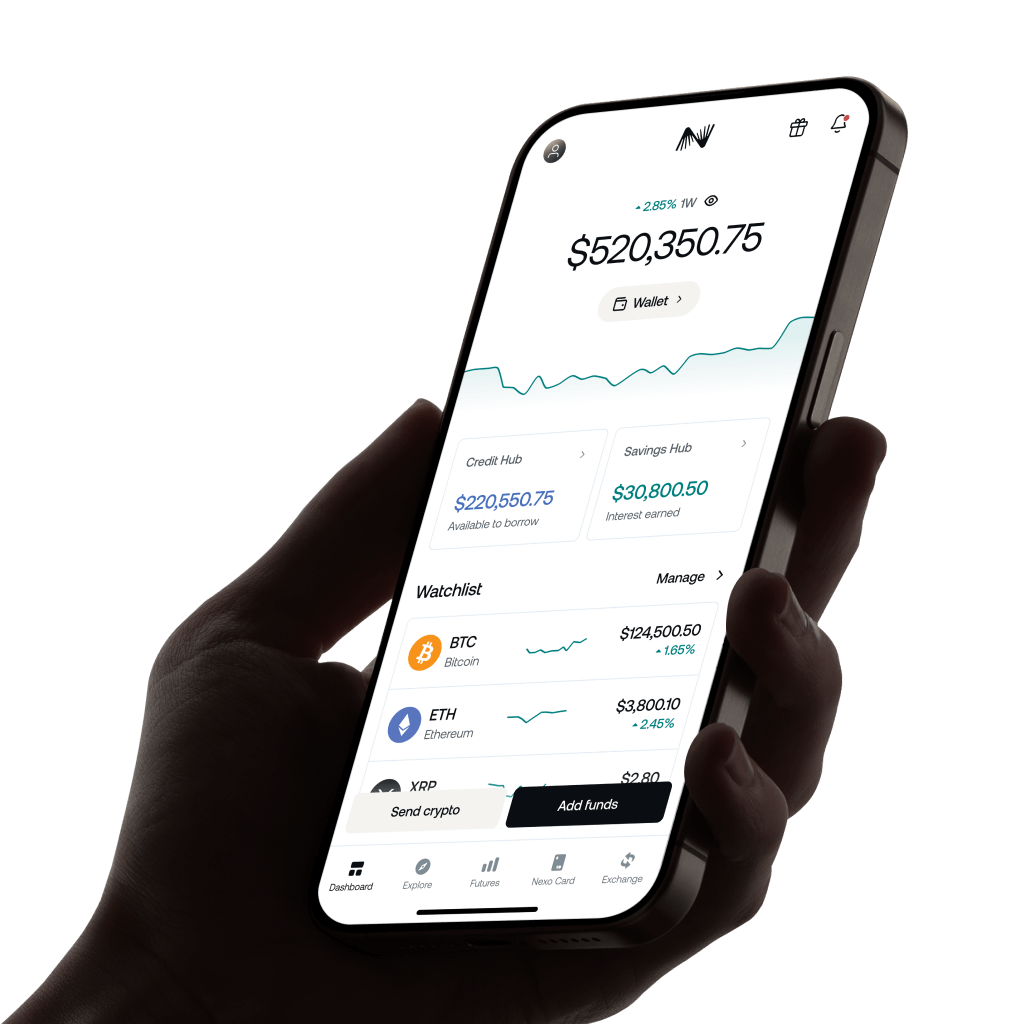

Earn High Yields on Your Crypto with Nexo

Earn, borrow, spend. All in one place.

The highest staking rewards rate is 13% APY for Tether (USDT) on Nexo. Other top rates: USDC at 12% APY, XRP at 11.5% APY, TRX at 11% APY. Compare staking rewards rates across 38+ cryptocurrencies.

| Coin | Platform | Staking rewards |

|---|---|---|

| Bitcoin (BTC) | Nexo | Up to 6.25% APY |

| Ethereum (ETH) | Nexo | Up to 7.25% APY |

| Tether (USDT) | Nexo | Up to 13% APY |

| BNB (BNB) | Nexo | Up to 7.5% APY |

| XRP (XRP) | Nexo | Up to 11.5% APY |

| USDC (USDC) | Nexo | Up to 12% APY |

| Solana (SOL) | Nexo | Up to 8% APY |

| TRON (TRX) | Nexo | Up to 11% APY |

| Dogecoin (DOGE) | Nexo | Up to 1% APY |

| Cardano (ADA) | Nexo | Up to 7.5% APY |

The Trusted Provider of Rates and Financial Information

Frequently Asked Questions About Crypto Staking Rewards

- What is crypto staking?

- Crypto staking is the process of actively participating in transaction validation on a proof-of-stake blockchain. Staking provides an opportunity to earn rewards, usually in the form of additional tokens, for helping to secure the network.

- How do you stake crypto?

- There are two ways to stake crypto: You can install a full node on your computer, or join a staking pool. Staking pools often have lower barriers to entry, allowing more users to participate in network validation.

- Can you earn interest on your staked crypto?

- Yes, you can earn interest on your staked crypto. The rewards vary depending on the blockchain network, with some platforms offering higher returns than others.

- Are there any fees associated with staking crypto?

- If you choose to use a staking pool, there are usually fees associated with staking crypto. These fees are generally deducted from your staking rewards, so it's essential to choose a pool with competitive fees.

- Is crypto staking legal?

- In general, staking crypto is a legal activity. However, the regulatory environment varies, so it's crucial to be aware of local laws that might affect staking rewards.

- What are the benefits of staking crypto?

- There are several benefits to staking crypto. It provides a passive income stream and contributes to the network's security, making it a win-win for both the staker and the blockchain.

- Is it safe to stake crypto?

- Crypto staking can be a safe way to earn rewards on your cryptocurrency holdings, but like any investment, you should be aware of its risks. Network security and staking pool reliability are important factors to consider.

- What security measures does Bitcompare recommend for staking?

- Bitcompare recommends using hardware wallets, 2FA, and staking through reputable platforms to minimize risk. These measures help ensure that your staked assets are protected against hacks and other security breaches.

- What happens if the network fails while I'm staking crypto?

- In the unlikely event of a network failure, your staked funds may be lost or become inaccessible, depending on the blockchain. It's essential to stake only on reputable networks and use reliable staking pools.

- What security measures does Bitcompare recommend for staking?

- Bitcompare recommends using hardware wallets, 2FA, and staking through reputable platforms to minimize risk. These security measures help protect staked assets from hacks and other vulnerabilities.