- What is The Sandbox (SAND) and how does it work?

- The Sandbox (SAND) is a blockchain-based virtual world where players can create, own, and monetize their gaming experiences and assets. Built on Ethereum, SAND acts as the native utility token used for governance, transactions, and staking within the ecosystem. Players can buy LAND parcels, create and trade in-game assets (via non-fungible tokens), and participate in a decentralized marketplace. The platform emphasizes user-generated content, providing creators with tools to design voxel assets, games, and experiences that can be monetized using SAND. If you’re new, start by acquiring SAND, visit a marketplace to explore assets, and consider joining the ecosystem through staking or governance participation.

- What is the current price and market status for SAND, and how does it fit into my portfolio?

- As of now, The Sandbox (SAND) trades at approximately $0.082 per token with a 24-hour price change around -3.2%. The circulating supply is about 2.667 billion with a max supply of 3.0 billion. Market capitalization sits in the low hundreds of millions range. When evaluating SAND for a portfolio, consider its volatility, the growth potential of the metaverse and user-generated content space, and your risk tolerance. If you’re risk-averse, allocate only a small percentage of your crypto holdings to high-growth, content-driven ecosystems. Regularly check price updates, news on platform adoption, and developments in the Sandbox ecosystem to inform rebalancing decisions.

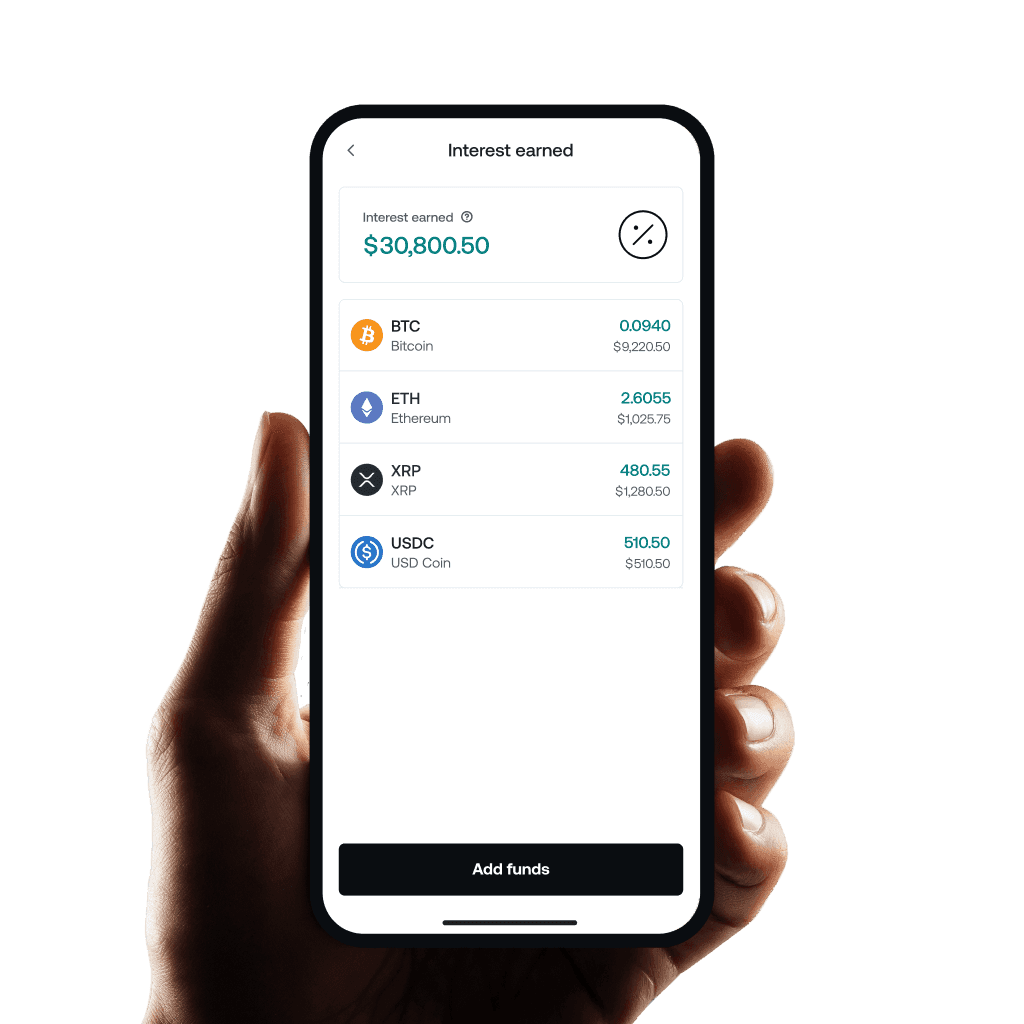

- How can I acquire SAND and participate in The Sandbox ecosystem?

- You can acquire SAND on major crypto exchanges that list the token. Once you own SAND, you can participate in the Sandbox ecosystem by: holding SAND to participate in governance and staking (if available on your platform), purchasing LAND parcels on the in-game marketplace or through secondary markets, buying, creating, and trading in-game assets as NFTs, and staking or providing liquidity if the platform or third-party services offer it. Before transacting, ensure you have a compatible wallet (e.g., MetaMask) and understand gas costs on the Ethereum network. Always use official channels for purchases to avoid scams, and consider diversifying your in-game assets to mitigate risk.

- What are LAND and ASSET NFTs in The Sandbox, and why do they matter?

- LAND is a programmable NFT representing virtual real estate within The Sandbox world, allowing owners to build experiences, games, and interactive content on their parcels. ASSET NFTs are modular, shareable 3D voxel assets (and consumables) that creators can sell or use in their experiences. Both types are tradeable on the in-game marketplace and can unlock revenue streams through experiences, gameplay, and user interactions. Ownership of LAND and assets is secured by blockchain, enabling true digital ownership and the potential for appreciation as the platform grows. If you’re considering investment, assess the value of strategic locations (LAND), creator demand for assets, and upcoming features that might boost traffic and usage inside the metaverse.

- What are the risks and considerations to keep in mind with The Sandbox and SAND?

- Key risks include price volatility typical of crypto assets and NFT-based ecosystems, regulatory uncertainty around virtual worlds and digital assets, and platform-specific risks such as software bugs, changes to governance, or shifts in the metaverse’s user base. There’s also exposure to gas fees on the Ethereum network during minting and trading of assets or LAND. Diversification helps manage risk. Stay informed about platform updates, security practices, and market sentiment. If you’re considering long-term involvement, evaluate fundamentals like user adoption, partnerships, development roadmap, and the strength of the creator economy within The Sandbox. Always only invest what you can afford to lose.