Vasiliy Shapovalov, Lido’s Co-Founder, claimed Coinbase and other "centralized exchanges" are threats to the firm at Ethereum Foundation’s Devcon 2022 event.

The news came a few days after Lido added support for Ethereum’s scaling protocols Arbitrum and Optimism.

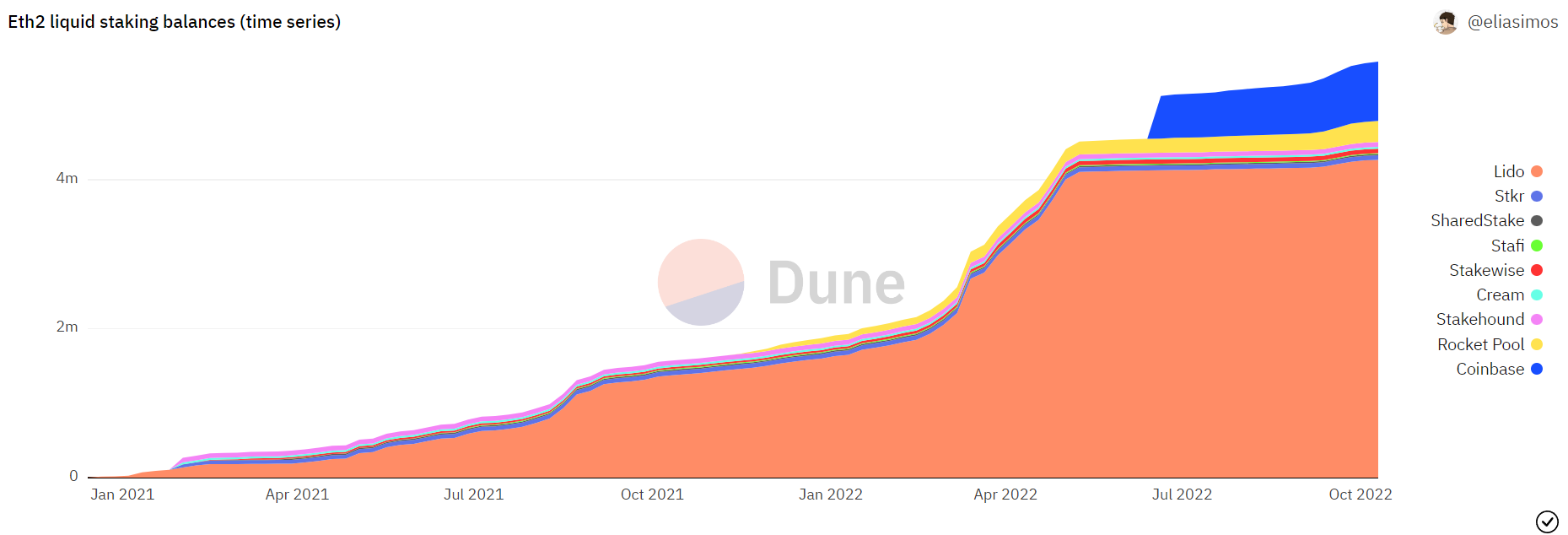

Before Coinbase entered the crypto staking scene, Lido held dominance over the liquid staking market. The firm currently holds $5.5B worth of staked Ethereum (stETH) tokens.

Meanwhile, Coinbase, which began providing staking services for stETH in June, has grown rapidly in the last few months. Data from Dune Analytics reveals Coinbase’s stETH tokens amount to $1B. An increase in Coinbase’s staking volume was observed after the exchange unveiled its cbETH token.

Shapovalov noted that the future of staking depends on the struggle between traditional finance and decentralized platforms. According to him, the liquid staking industry may soon be dominated by protocols similar to Lido or centralized crypto exchanges.

Get Our Free Newsletter

Subscribe to our newsletter to get tips, our favorite services, and the best deals on Bitcompare-approved picks sent to your inbox

He acknowledged that stETH declined after 3AC declared bankruptcy, adding,

“People [were] eager to buy cheap staked ETH. We need to have enough price discovery and for momentary liquidity pools to fill that bid.”

After stating that Lido has spent millions to increase the liquidity of stETH, he remarked that these incentives may soon become unnecessary.