The cryptocurrency exchange landscape in 2026 is dominated by two major players: Coinbase and Binance. Both platforms serve millions of users worldwide, but they cater to different trading needs and experience levels. While Coinbase emphasizes simplicity and regulatory compliance with support for over 260 cryptocurrencies, Binance offers advanced trading features and access to more than 350 digital assets globally (150+ on Binance.US). For a comprehensive overview of all top platforms, see our detailed guide to the best crypto exchanges available today.

This comprehensive comparison examines trading fees, security measures, supported cryptocurrencies, and user experience to help you choose the right platform for your crypto journey in 2026.

Last updated: February 11, 2026

At-a-Glance Comparison: Coinbase vs Binance 2026

| Feature | Coinbase | Binance |

|---|---|---|

| Best For | Beginners, US regulation-focused | Advanced traders, global features |

| Founded | 2012 | 2017 |

| Cryptocurrencies | 260+ | 350+ (150+ US) |

| Trading Fees | 0.60% maker / 1.20% taker | 0.1% spot / 0% maker tier 0 (US) |

| FDIC Insurance | USD deposits only | None |

| Advanced Trading | Limited | Comprehensive |

Trading Fees: Binance Takes the Lead

Trading fees are a crucial factor when choosing an exchange. Binance consistently offers lower fees across all trading pairs, making it more cost-effective for frequent traders.

Coinbase Fee Structure 2026

Coinbase operates on a maker-taker model with fees ranging from 0.40% to 1.20%. Regular spot rates start at 0.60% for makers and 1.20% for takers. However, Coinbase One subscribers ($29.95/month) enjoy no-fee trading for up to $10,000 in trades per month, which can be valuable for moderate traders.

Binance Fee Structure 2026

Binance.US offers the most competitive fee structure in 2026, featuring 0% maker fees on Tier 0 pairs and just 0.01% taker fees for all customers, with no subscription requirements. International Binance users pay 0.1% for spot trading, with futures trading as low as 0.02% for makers and 0.05% for takers.

| Fee Type | Coinbase | Binance US | Binance Global |

|---|---|---|---|

| Spot Trading (Maker) | 0.60% | 0% (Tier 0) | 0.1% |

| Spot Trading (Taker) | 1.20% | 0.01% | 0.1% |

| BNB Discount | N/A | 5% | 25% |

| Futures Trading | Not available | Limited | 0.02%-0.05% |

| Crypto Deposits | Free | Free | Free |

| ACH/Bank Transfers | Free | Free | Varies by region |

Security and Regulation: Different Approaches

Both exchanges prioritize security, but they take different regulatory approaches that affect user protection and compliance.

Coinbase Security Features

Coinbase emphasizes regulatory compliance and offers FDIC insurance for USD deposits (up to $250,000) through partner banks. The platform stores 98% of customer funds in offline cold storage and provides additional insurance coverage for hot wallet holdings. Key security features include:

- FDIC insurance for USD deposits

- Two-factor authentication (2FA)

- Biometric login options

- Cold storage for crypto assets

- Advanced monitoring systems

- Regulatory compliance with US authorities

Binance Security Measures

While Binance doesn"t offer FDIC insurance, it maintains a comprehensive security framework including a $1 billion SAFU (Secure Asset Fund for Users) emergency fund. Security features include:

- Secure Asset Fund for Users (SAFU)

- Advanced AI monitoring

- IP whitelisting

- Address management

- Cold storage for most funds

- Regular security audits

| Security Feature | Coinbase | Binance |

|---|---|---|

| FDIC Insurance | USD deposits only | None |

| Emergency Fund | Private insurance | $1B SAFU fund |

| Cold Storage | 98% of funds | 95%+ of funds |

| 2FA Options | SMS, Authenticator, Hardware | SMS, Authenticator, Hardware |

| Regulatory Status | Strong US compliance | Global, limited US presence |

Cryptocurrency Selection and Trading Options

The breadth of cryptocurrency support varies significantly between the two platforms, with Binance offering a much wider selection globally.

Coinbase Cryptocurrency Support

Coinbase supports over 260 cryptocurrencies and 400+ trading pairs as of 2026. The platform focuses on high-quality assets with strong regulatory compliance, including major cryptocurrencies like Bitcoin, Ethereum, Solana, and Cardano. Coinbase tends to be more selective in listing new tokens, prioritizing established projects.

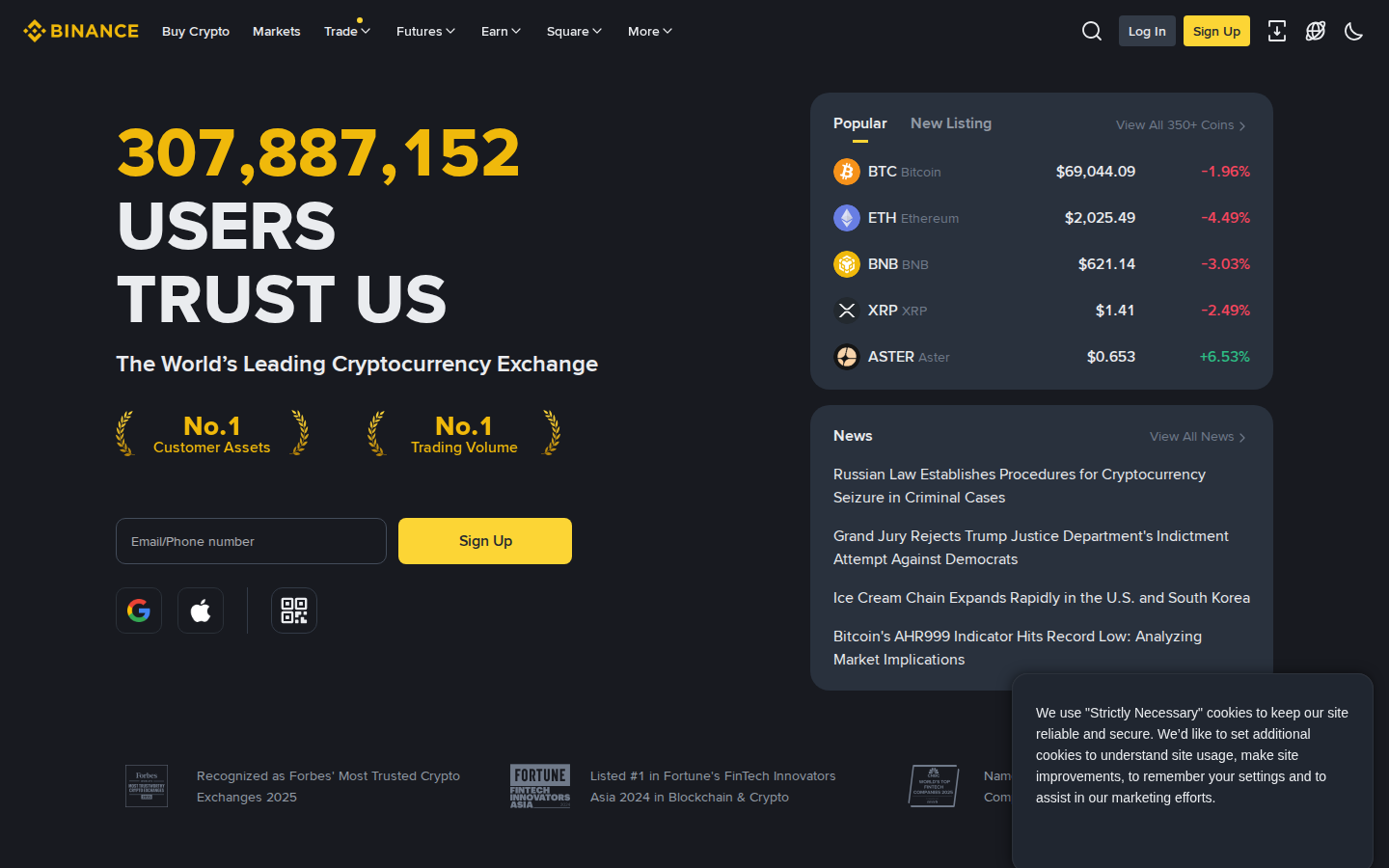

Binance Cryptocurrency Diversity

Binance offers the most comprehensive cryptocurrency selection, supporting over 350 digital assets globally. Binance.US operates under stricter regulations with 150+ supported cryptocurrencies. The platform is known for early access to new tokens and emerging altcoins, making it attractive to traders seeking diverse investment opportunities.

User Experience and Interface Design

The platforms cater to different user segments, with distinct approaches to interface design and functionality.

Coinbase: Simplicity First

Coinbase prioritizes user-friendly design with an intuitive interface perfect for beginners. The platform offers:

- Clean, minimalist dashboard

- Simplified buy/sell process

- Educational resources through Coinbase Learn

- Mobile app with full functionality

- Integrated wallet services

Binance: Professional Trading Focus

Binance provides a more complex interface designed for serious traders, featuring:

- Advanced charting tools

- Multiple order types (limit, stop, OCO)

- TradingView integration

- Customizable dashboards

- Professional-grade analytics

Additional Features and Services

Both platforms extend beyond basic trading to offer comprehensive crypto ecosystems.

Coinbase Ecosystem

- Coinbase Earn: Learn about cryptocurrencies and earn rewards

- Coinbase Card: Spend crypto anywhere Visa is accepted

- Coinbase Wallet: Non-custodial wallet for DeFi access

- Institutional services: Coinbase Prime for large traders

- NFT marketplace: Buy, sell, and create NFTs

Binance Ecosystem

- Binance Smart Chain: Native blockchain for DeFi applications

- Binance Academy: Comprehensive crypto education

- Launchpad: Early access to new token launches

- P2P trading: Direct peer-to-peer transactions

- Binance Pay: Cryptocurrency payment solution

- Futures and options: Advanced derivatives trading

Geographic Availability and Regulations

Regulatory compliance affects where these platforms operate and what services they can offer.

Coinbase Geographic Reach

Coinbase operates in over 100 countries with strong regulatory compliance. In the US, it"s fully licensed and regulated, making it a trusted choice for American users. The platform has restricted operations in several countries due to regulatory requirements.

Binance Global Presence

Binance operates globally but faces regulatory challenges in some regions. Binance.US serves American customers with limited features compared to the international version. The platform has been banned or restricted in several countries, including the UK and certain US states.

Staking and Yield Opportunities

Both platforms offer ways to earn passive income on cryptocurrency holdings through staking and lending programs.

| Cryptocurrency | Coinbase APY | Binance APY | Binance US APY |

|---|---|---|---|

| Ethereum (ETH) | 3.2% | 4.5% | 3.8% |

| Cardano (ADA) | 3.7% | 5.2% | 4.1% |

| Solana (SOL) | 6.8% | 7.3% | 6.2% |

| Polkadot (DOT) | 11.5% | 12.8% | 11.2% |

Note: Staking rewards are subject to change and may vary based on network conditions. Binance.US deducts 9.95-39.95% service fees from staking rewards.

Customer Support Comparison

Customer support quality can be crucial when dealing with technical issues or account problems.

Coinbase Support

Coinbase offers multiple support channels including email, live chat, and phone support for eligible users. The platform provides extensive help documentation and typically responds to inquiries within 24-48 hours. Premium users receive priority support.

Binance Support

Binance provides 24/7 customer support through live chat and email. The platform offers multilingual support and extensive FAQ resources. Response times vary but are generally faster for verified accounts and higher-tier users.

Mobile App Experience

Both platforms offer comprehensive mobile applications with most desktop features available on the go.

Coinbase Mobile App

The Coinbase mobile app maintains the platform"s user-friendly approach with:

- Intuitive design matching desktop experience

- Full trading functionality

- Price alerts and portfolio tracking

- Coinbase Card integration

- Secure biometric authentication

Binance Mobile App

Binance"s mobile app offers professional-grade features including:

- Advanced charting and technical analysis

- Complete trading suite

- Real-time market data

- P2P trading capabilities

- Futures and margin trading

Pros and Cons Analysis

Coinbase Advantages

- Excellent for beginners with intuitive interface

- Strong regulatory compliance and FDIC insurance for USD

- High security standards and insurance coverage

- Wide geographic availability

- Educational resources and earn programs

- Integrated payment solutions

Coinbase Disadvantages

- Higher trading fees compared to competitors

- Limited advanced trading features

- Smaller cryptocurrency selection

- No futures or margin trading

- Higher withdrawal fees for some cryptocurrencies

Binance Advantages

- Lowest trading fees in the industry

- Largest cryptocurrency selection globally

- Advanced trading features and tools

- Comprehensive DeFi ecosystem

- High liquidity across all markets

- Multiple earning opportunities

Binance Disadvantages

- Complex interface overwhelming for beginners

- Regulatory uncertainties in some regions

- No FDIC insurance protection

- Limited US services through Binance.US

- Occasional technical issues during high traffic

Which Exchange Should You Choose?

The choice between Coinbase and Binance depends on your trading experience, geographic location, and specific needs.

Choose Coinbase If:

- You"re new to cryptocurrency trading

- You prioritize regulatory compliance and insurance

- You prefer simple, straightforward interfaces

- You"re based in the United States

- You want integrated payment and card services

- You don"t mind paying higher fees for convenience

Choose Binance If:

- You"re an experienced trader seeking advanced features

- You want access to the widest range of cryptocurrencies

- You prioritize low trading fees

- You"re interested in DeFi and emerging technologies

- You need futures, margin, or options trading

- You"re comfortable with complex interfaces

Alternative Exchanges to Consider

While Coinbase and Binance dominate the market, other exchanges may better suit specific needs:

- Kraken - Strong security and European focus

- Gemini - Regulated US exchange with high security

- Crypto.com - Comprehensive ecosystem with rewards

- KuCoin - Wide altcoin selection

Related Articles

Explore more exchange comparisons and trading guides:

- Gemini vs Kraken: Unbiased Review of Top Crypto Exchanges

- Kraken vs Coinbase: Navigating Best Cryptocurrency Exchange

- Coinbase vs Gemini: Finding Your Ideal Crypto Exchange

- Binance vs OKX: The Ultimate Crypto Exchange in 2026

- Coinbase vs OKX Showdown: Top Crypto Exchange in 2026

Frequently Asked Questions

Is Coinbase or Binance safer for beginners?

Coinbase is generally safer for beginners due to its regulated status, FDIC insurance for USD deposits, and user-friendly interface. While Binance offers advanced security features, its complexity can lead to user errors for inexperienced traders.

Which exchange has lower trading fees in 2026?

Binance consistently offers lower trading fees, with Binance.US providing 0% maker fees and 0.01% taker fees on most pairs. Coinbase charges 0.60% maker and 1.20% taker fees, making it significantly more expensive for frequent trading.

Can US residents use both Coinbase and Binance?

US residents can use Coinbase fully and Binance.US with limitations. The international Binance platform is not available to US customers due to regulatory restrictions. Binance.US offers fewer features and cryptocurrencies compared to the global platform.

Does Coinbase or Binance offer better staking rewards?

Binance generally offers higher staking rewards across most cryptocurrencies, with rates typically 1-2% higher than Coinbase. However, Binance.US deducts significant service fees (9.95-39.95%) from staking rewards, which may reduce the advantage.

Which platform supports more cryptocurrencies?

Binance supports over 350 cryptocurrencies globally, significantly more than Coinbase"s 260+ offerings. However, Binance.US only supports around 150 cryptocurrencies due to regulatory requirements in the United States.

Are my funds insured on Coinbase and Binance?

Coinbase provides FDIC insurance for USD deposits up to $250,000 and additional insurance for hot wallet crypto holdings. Binance maintains a $1 billion emergency fund (SAFU) but doesn"t offer traditional insurance coverage like FDIC protection.

Which exchange is better for advanced traders?

Binance is superior for advanced traders, offering comprehensive features including futures trading, margin trading, advanced order types, and professional-grade charting tools. Coinbase Pro (now Coinbase Advanced) provides basic advanced features but lacks the depth of Binance"s offerings.

How do withdrawal fees compare between the two exchanges?

Withdrawal fees vary by cryptocurrency and network conditions. Binance typically offers competitive withdrawal fees with periodic promotions for zero-fee withdrawals. Coinbase withdrawal fees are generally higher, particularly for popular cryptocurrencies like Bitcoin and Ethereum, but the platform occasionally offers free withdrawal promotions.

Our Comparison Methodology

This Coinbase vs Binance comparison is based on hands-on testing and comprehensive research:

- Fee verification: We documented current fee schedules from both platforms' official pricing pages.

- Feature testing: We reviewed trading interfaces, security features, and account functionality on both platforms.

- Security assessment: We evaluated insurance coverage, regulatory status, and security certifications.

- Rate comparison: We cross-referenced staking APYs and fee structures across both exchanges.

- Community feedback: We analysed user reviews, app ratings, and customer support experiences.

Bitcompare maintains editorial independence. Where affiliate links are present, they do not affect our analysis or recommendations.

Both Coinbase and Binance serve important roles in the cryptocurrency ecosystem. Coinbase excels as a beginner-friendly, regulated platform perfect for those prioritizing security and simplicity. Binance dominates with its comprehensive feature set, low fees, and extensive cryptocurrency selection, making it ideal for serious traders and crypto enthusiasts. Your choice should align with your experience level, trading frequency, and regulatory preferences.

Ready to start trading? Compare current rates and features on Bitcompare to find the best exchange for your specific needs.