With the rise of cryptocurrency, users used to be engaged in peer-to-peer transactions called P2P using digital currencies such as Bitcoin. For the time being, crypto cards have broken through the crypto world. It has become much easier for crypto users to convert digital currencies into fiat money for everyday payments.

Crypto debit cards allow you to pay with cryptocurrency in both online and offline stores, as well as withdraw cash from almost any ATM all around the world. At the same time, each company that issues such cards has its own privileges for users. So if you are in the dark about crypto cards, it’s the right time to know what’s what.

What Is a Crypto Card?

Traditional banking is fading away and crypto banking is starting to erupt. Crypto cards use the same principle as traditional debit or credit cards but with more options and opportunities. Making everyday transactions using a crypto card is a piece of cake. And many crypto cards are co-branded with Visa and Mastercard, meaning they can be used in millions of places.

Let’s dive into the process of how crypto cards work. Firstly, you top up your crypto debit card with the digital currency of your choice. In most cases, crypto users do it via a mobile app or website. Then you can proceed with your purchases. Many crypto debit cards offer generous spending limits as well as low transaction fees.

Let’s say you finally buy that long-awaited cappuccino with your crypto debit card. Once the transaction is complete, the card provider converts the digital currency into cash, meaning the coffee shop will receive your payment in fiat currency, such as US dollars, pounds, or euros.

Top Crypto Cards in the Market

CrossFi Crypto Card

The Crypto card by CrossFi allows for all user-friendly features. The CrossFi crypto card is connected to MetaMask and has its own XFI coin. These options bring about the conversion of cryptocurrencies into fiat currency instantly at the point of sale.

Coinbase Card

The Coinbase card is linked directly to your Coinbase account, allowing you to spend your crypto holdings anywhere that accepts Visa. Users can pick out which cryptocurrency to spend at checkout, and the card offers rewards in the form of crypto, enhancing its appeal.

Crypto.com Visa Card

The Crypto.com Visa card is popular for its tiered rewards system, where users can earn up to 8% cashback on purchases depending on their staking level. The card will never let you down with a wide range of cryptocurrencies and benefits like free Spotify and Netflix subscriptions for higher-tier cardholders.

Binance Card

It is hard to imagine the crypto world without Binance, one of the largest cryptocurrency exchanges. The Binance card automatically converts cryptocurrency to fiat at the time of purchase, users can earn cashback on purchases and benefit from low fees, making it a solid choice for frequent traders.

BitPay Card

Try out the BitPay card if you would like to spend Bitcoin and other cryptocurrencies easily. It allows users to load funds from their BitPay wallet and convert them into USD for spending. The card is widely accepted and comes with a straightforward fee structure, making it a practical option for Bitcoin enthusiasts.

How to Choose the Right Crypto Card

Crypto cards turn out to be a convenient solution for everyday payments. Moreover crypto debit cards allow users to convert crypto to fiat money in an easy way. We all know that it can be quite challenging to choose the right crypto card. Here’s a guide to help you not to go astray in the crypto world.

Step 1. Understand Your Needs

Here are three questions that we offer you to answer to catch on your personal needs and usage patterns:

- Will you use the card for daily purchases or occasional transactions?

- Are there specific cryptocurrencies you want to spend money on?

- Are you looking for cashback, rewards points, or other incentives?

Step 2. Check Supported Cryptocurrencies

We recommend you dig up and to choose the crypto you want to buy up before starting to pick out a crypto card. One crypto card cannot support all cryptocurrencies. Most popular cryptocurrencies are Bitcoin (BTC) and Ethereum (ETH), and also some stablecoins such as USDC or USDT.

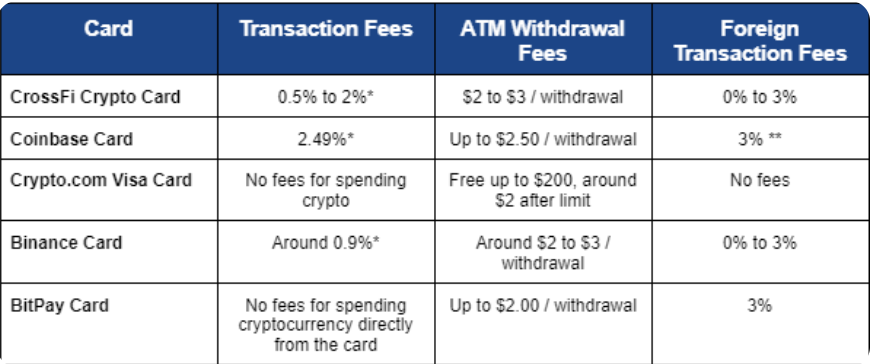

Step 3. Evaluate Fees

Crypto cards may come with various fees, for example:

Compare these fees across different cards to find one that aligns with your budget.

Step 4. Consider Security Features

Security is paramount when dealing with cryptocurrencies. Read up about the cards that offer robust security features such as:

- Two-Factor Authentication / 2FA — An extra layer of protection for your account.

- Fraud Monitoring — Alerts for suspicious transactions.

- Insurance Coverage — Some cards offer insurance against theft or loss.

Step 5. Review User Experience

A user-friendly interface can significantly enhance your experience. Look for cards that offer:

- Mobile app. We are absolutely sure that if the card has an app it stands out from other crypto cards. Moreover a well-designed app will aid you in managing your account and transactions.

- Customer support. Access to responsive customer service for assistance.

Reading user reviews and testimonials mounts up the chance that you will find the right card for your needs.

Step 6. “Check Geographical Accessibility”

Make sure to consider the regional availability while choosing crypto card. Some crypto cards can be inaccessible in some countries.

Here you can find the graph with the percentage of crypto card holders in different regions:

Step 7. Explore Additional Features

Many crypto cards come with ground-breaking features that can add value, such as:

- Earning rewards by holding certain cryptocurrencies

- Virtual cards for online purchases without exposing your physical card

- Integration with exchanges. Seamless transfers between your exchange account and the card.

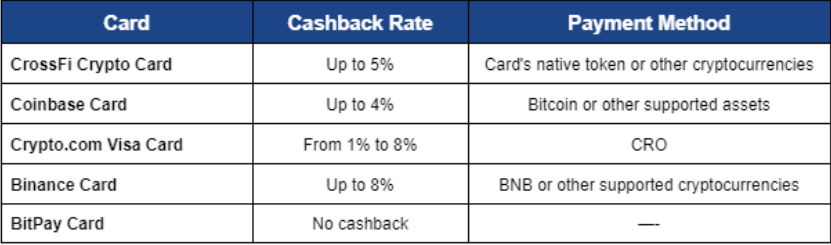

Step 8. Learn Cashback Options

Conclusion

Crypto cards make it much easier for the average user to use cryptocurrencies. Moreover, they do not have the same limits as fiat payments, and the fees for transfers are much lower.