Picking the best crypto exchange in 2025 isn’t just about chasing the lowest posted fee. It’s about trust, the true cost you’ll pay per trade, and whether the platform actually serves you where you live.

If you’re a U.S. reader, availability can vary state by state, and certain features (staking, derivatives, specific stablecoins) may be limited. If you’re in the EU, country rules and verification steps differ, even when an exchange operates across the bloc. The same brands may offer different experiences.

In this guide we focus on what matters in real life: the all-in price of buying and selling (maker/taker fees plus spread, plus funding/withdrawal costs), security practices you can verify (proof-of-reserves disclosures, hardware-backed cold storage, and withdrawal protections), and day-to-day usability (order types, mobile app quality, support response times, fiat ramps like ACH/SEPA, and transparent status pages).

We also weigh asset depth and liquidity—because a good price on paper means little if your order slips when it hits the book.

One more thing: exchanges are excellent for on- and off-ramps and active trading, but long-term holdings belong in a digital wallet you control.

Use platforms for convenience; use self-custody for savings. Throughout, we’ll flag who each pick is for—beginners who want a clean app, cost-conscious traders who care about spreads, and power users who need advanced charts, APIs, or futures.

Best Crypto Exchanges: Our Top Picks

Best for: Beginners & clean UX

Best for: Beginners & clean UX

Coinbase

A polished, regulated on-ramp with a familiar app and clear Advanced Trade fees. Great first stop for US users; EU support continues to expand.

Key Highlights

Why It’s Worth Noting

- Simple onboarding and intuitive UI

- Advanced Trade with posted maker/taker tiers

- Strong liquidity on major pairs

Room for Improvement

- “Simple” buys can cost more than Advanced Trade

- Feature set varies by country/state

Best for: Mobile-first & rewards

Best for: Mobile-first & rewards

Crypto.com

Mobile-first exchange with a broad product surface and visible proof-of-reserves resources. Availability and features can vary by jurisdiction.

Key Highlights

Why It Stands Out

- Excellent mobile app experience

- Public proof-of-reserves materials

- Wide product lineup (region-dependent)

Potential Drawbacks

- Some features not available in certain countries/states

- Rewards/tiers can change; review current terms

Best for: Security & compliance

Best for: Security & compliance

Gemini

Security-forward approach with NY trust company status and emphasized audits/certifications. A fit for users who value governance and transparency.

Key Highlights

Why It’s Notable

- NYDFS-regulated trust company posture

- SOC certifications & public security disclosures

- Clear separation of core exchange vs add-ons

Where It Falls Short

- Conservative listings vs some rivals

- Past program issues; check current availability

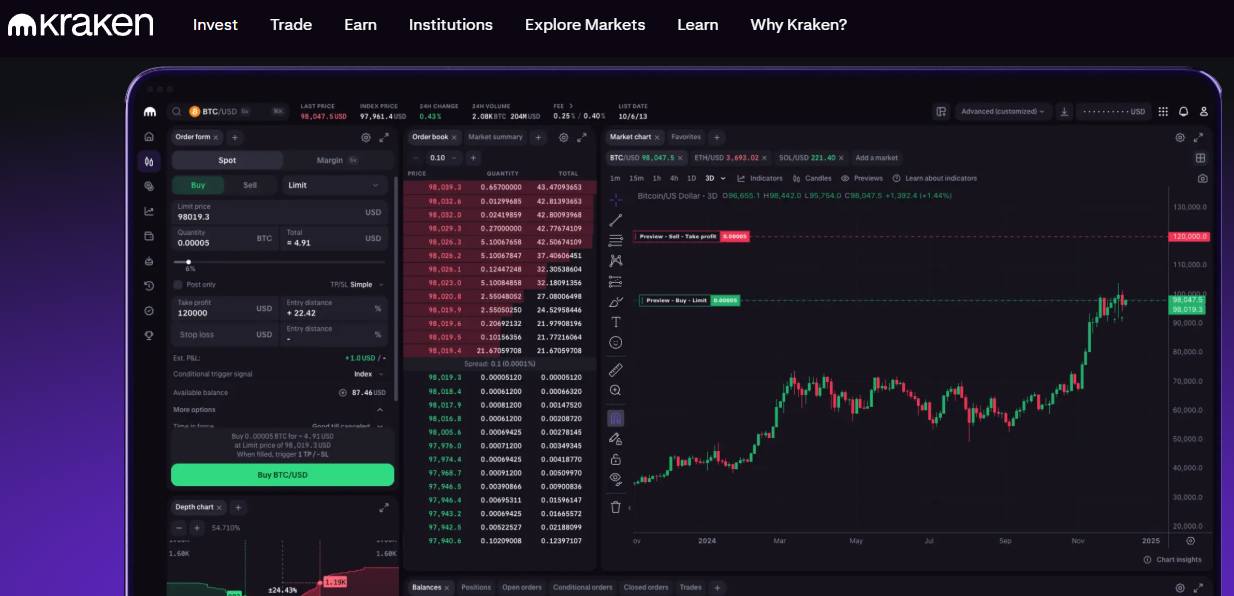

Best for: Active traders & depth

Best for: Active traders & depth

Binance

Large global liquidity and a deep feature set. Availability and specific products depend on your country; always check the regional site.

Key Highlights

Why Traders Like It

- Strong liquidity on many markets

- Advanced trading tools & APIs

- Competitive posted fees on select pairs

Compliance Caveats

- Regional availability & features vary

- Compliance requirements differ by jurisdiction

How to Choose Top Crypto Exchanges in 2025 (5-Step Mini-Guide)

Picking an exchange isn’t about chasing the lowest headline fee.

It’s about the real cost of a trade, how safely your assets are held, and whether the platform is actually available with the features you need where you live (US state by state; EU country by country). Use this quick five-step flow to shortlist with confidence.

1. Count the Real Fees You’ll Actually Pay

- Add spread + maker/taker + funding/withdrawal to get your all-in cost.

- Prefer ACH/SEPA and bank transfers over cards when possible.

- Use the “Advanced/Pro” trade screen—simple buys often carry higher effective costs.

2. Verify Security & Proof-of-reserves

- Look for hardware-backed cold storage, address allow-listing, and strong 2FA.

- Check if the exchange publishes independent proof-of-reserves (and how it’s verified).

- Understand what insurance does—and doesn’t—cover (it rarely covers market losses).

3. Confirm US/EU Availability & Licensing

- US: features vary by state; confirm what’s supported before you fund.

- EU: check country availability and whether the entity operating in your country is authorized.

- When in doubt, read the legal/terms page linked in the app footer.

4. Match Asset Selection & Liquidity to Your Plan

- If you buy majors (BTC/ETH/stablecoins), prioritize deep order books over exotic listings.

- For long-tail assets, verify liquidity on the pairs you’ll actually trade.

- Active traders: confirm advanced order types, APIs, and margin/futures (where permitted).

5. Test the UX and Support Before Committing

- Send a support ticket and note response times.

- Try a tiny deposit + test withdrawal to your crypto wallet to confirm flows.

- Check the status page/history for downtime around volatile periods.

Head to Head Comparison

Quick snapshot of what matters most: all-in fees, funding/withdrawal frictions, where each platform is live (US/EU) and its license signals, plus security & proof-of-reserves (PoR) posture.

| Exchange | All-in Fees (Maker/Taker + Spread) | Funding / Withdrawal | US/EU Availability & License Signals |

|---|---|---|---|

| Coinbase | Advanced Trade uses tiered maker/taker; “Simple” buys can be pricier; spreads vary by route. | ACH/SEPA usually lowest; cards higher; standard network fees on crypto withdrawals. | Broad US/EU access; US MSB + state licenses; EU via local entities (features can vary by state/country). |

| Crypto.com | Posted maker/taker tiers; spreads depend on pair/liquidity; VIP tiers can reduce costs. | ACH/SEPA supported; card deposits may incur fees; standard on-chain withdrawal fees. | US/EU available; product scope (earn/derivatives) varies by jurisdiction; multiple local registrations. |

| Gemini | ActiveTrader maker/taker schedule; simple buys can cost more; spreads vary with route. | ACH/wires; network fees apply; check current free-withdrawal allowances if any. | Wide US coverage; NYDFS Trust Company; EU/UK via local entities (feature availability varies). |

| Binance | Low posted maker/taker on many pairs; tiered VIP discounts; spreads pair-dependent. | SEPA/bank transfers region-dependent; standard network withdrawal fees. | Availability/features differ by country; licenses/registrations vary; use your regional site. |

Editor note: Fees, features, and availability change by jurisdiction and account tier. Always confirm current schedules, PoR pages, and terms on the official sites.

The True Cost of Trading: Fees Deconstructed

Sticker fees don’t tell the whole story. Your real price to buy or sell crypto is a stack of moving parts. Cards may also bring credit card rewards, but you still need to repay balances, so weigh perks against risk. Some VIP tiers only apply once you hit eligible volume thresholds—so plan your trades to maximize those discounts.

Remember, every merchant treats card funding differently, and a tiny investment in learning fee structures can help you save big over time.

Spreads vs Posted Fees

Posted fees are the obvious ones on the pricing page. Spreads are quieter. They widen when markets move fast, on thin pairs, or in “simple buy” flows that wrap convenience into the quote. If you can, compare the Advanced/Pro price to a public mid-price and you’ll see it.

ACH/SEPA vs Card Funding

Bank rails (ACH/SEPA, wires) are usually the cheapest way to move fiat in and out. Cards are fast but pricey and sometimes treated like cash advances. Always check both deposit and withdrawal costs—saving 1% on the way in is wasted if you lose 2% on the way out.

When using cards, remember that merchants may treat crypto top-ups differently, and you’ll still need to repay the balance like any other expense.

“No-fee” and Subscription Tiers

Some plans reduce posted fees or waive them entirely, but they may charge a monthly price or recoup via spread. Some also dangle perks like credit card rewards on top of trading volume, but the math only works if your daily spending is consistent and you’re not carrying a balance.

How to Actually Lower Your Costs

- Use Advanced/Pro (limit orders) when speed isn’t critical.

- Prefer ACH/SEPA for funding; avoid card routes unless you need instant settlement.

- Trade when books are thick (US/EU market hours overlap) to reduce spread.

- Watch tier thresholds; a small bump in volume can drop your fee bracket.

- Withdraw to self-custody in fewer, larger batches to amortize network fees.

Think of trading as an investment in efficiency—choosing the right routes and habits can compound real savings.

Security & Trust in 2025: What “Safe” Really Means

“Safe” isn’t a vibe; it’s a checklist. In 2025, trust boils down to how assets are stored, what you can independently verify, and how the platform behaves when things go wrong. Being regulated helps—but regulation alone doesn’t make an exchange risk-free. Treat exchanges as convenient on/off-ramps and trading venues; keep long-term holdings in a wallet you control.

What to Look For (And Why It Matters):

- Custody architecture (cold vs hot, HSM/MPC). Most customer assets should sit in offline cold storage with tightly controlled access. Hot-wallet balances should be limited and monitored.

- Account security controls. Prefer TOTP or security keys over SMS; use withdrawal allow-listing, device approvals, API key scopes/IP allowlists, and anti-phishing codes.

- Proof-of-Reserves (PoR)—with context. A Merkle-tree snapshot is useful only if liabilities are included, methodology is explained, and the cadence is regular. PoR is a point-in-time check, not a perpetual guarantee.

- Audits & certifications. SOC 2 Type II, ISO/IEC 27001 (and 27701 for privacy) signal disciplined processes; add regular pen-tests and a live bug-bounty program.

- Insurance (what it does and doesn’t do). “Crime” or “hot-wallet” insurance usually covers specific security incidents—not market losses, user error, or insolvency. FDIC/FSCS deposit insurance does not protect crypto balances.

- Regulation ≠ risk-free. Licenses (e.g., NYDFS trust, EU VASP/MiCA) improve oversight, but execution risk, counterparty risk, and policy changes still exist. Always read the entity you’re actually contracting with.

User Habits That Move the Needle:

- Use a hardware wallet for savings; keep only active funds on exchange.

- Turn on 2FA (TOTP or security key), enable withdrawal allow-lists, and run a $10 test withdrawal before moving size.

- Don’t click trade links from email. Navigate directly, verify the URL, and set an anti-phishing code in your profile.

- Review the exchange’s status page and security/transparency hub before funding.

US vs EU Rules (GENIUS Act, MiCA/TFR)

If you’re in the US, the big new rule set is the GENIUS Act. It’s now law (signed July 18, 2025), and it focuses on payment stablecoins.

In short: only approved issuers can mint dollar-backed coins for U.S. users, they must keep 1:1 reserves in cash or similarly liquid assets, publish monthly reserve details, and redeem at par.

Issuers can choose a federal charter or operate under a state framework (with caps for state-level issuance). GENIUS also says these payment stablecoins aren’t securities, but issuers still have to follow Bank Secrecy Act/AML rules. For everyday users, that means more standardized issuers, clearer redemption rights, and more frequent transparency reports.

In the EU, the framework is MiCA plus the Transfer of Funds Regulation (TFR).

MiCA arrived in two waves: rules for stablecoins (ARTs/EMTs) started June 30, 2024, while rules for CASPs (exchanges, brokers, custodians) kicked in December 30, 2024—with a transitional “grandfathering” window to July 1, 2026 for firms already operating before that date. Licensed CASPs get EU passporting (serve the whole EU off one license), but grandfathered firms don’t enjoy passporting until they obtain a full MiCA authorization.

For users, this should mean more consistent disclosures, complaints handling, and a single license you can look up across the bloc.

The TFR is the EU’s “travel rule.” It has applied since December 30, 2024 and requires CASPs to send/receive originator and beneficiary info with every CASP-to-CASP crypto transfer (no de-minimis threshold), and to verify ownership when you transfer to/from a self-hosted walletabove €1,000 (below that, they generally collect info without verification).

In practice, you’ll see extra prompts when withdrawing to your own wallet and occasional holds while details are checked.

CEX vs DEX vs Hybrids: Which Model Fits You?

Here’s a deeper, plain-English explainer that helps readers feel the differences and pick the right fit without touching code.

CEX (Centralized Exchanges): Convenience You Can Live With

A CEX is the familiar “bank-like” experience: email + KYC, fiat rails (ACH/SEPA, cards, wires), order books, customer support, and a slick mobile app. You deposit dollars/euros and the exchange holds your coins in a custodial wallet. That custody is both the feature and the trade-off.

Why People Like CEXs

- Fast on-ramps/off-ramps and recurring buys.

- Deep liquidity on majors (BTC, ETH, big caps) → tighter spreads.

- A single app for spot trading, price alerts, watchlists, tax exports.

What to Watch:

- You don’t hold the keys. Outages, withdrawal delays, or policy changes can pinch at the worst moments.

- Features vary by region (e.g., staking or derivatives may be limited in some US states/EU countries).

- “Simple” buy flows can hide spread—Advanced/Pro screens are usually cheaper.

DEX (Decentralized Exchanges): Control You Can Verify

A DEX runs on smart contracts. You connect your wallet (ideally a hardware wallet), approve a trade, and it settles on-chain.

There’s no account to freeze. No “support queue” to get in your way. Power and responsibility come bundled.

Why People Like DEXs

- Self-custody by default—assets stay in your wallet until you trade.

- Broad/long-tail access: new tokens, niche pairs, cross-chain routes.

- Transparent settlement you can check on a block explorer.

What to Watch:

- You are the security team: seed phrase, approvals, phishing, fake tokens.

- On-chain costs (gas), slippage, and MEV can eat into small trades.

- Fiat ramps are limited—you’ll usually fund via a CEX or on-ramp first.

Hybrids: Meeting in the Middle

“Hybrid” isn’t one thing; think of it as a spectrum:

- CeDeFi front-ends: CEX-style UI with more on-chain proofs (PoR, on-chain settlements for certain products).

- Non-custodial exchange accounts: MPC/smart-wallet setups where the platform can’t move funds without you.

- Institutional rails: off-exchange settlement and segregated custody with exchange connectivity.

Where It's Headed

- Account-abstraction wallets that feel like apps but keep keys user-side.

- More on-chain receipts/proofs behind “normal” CEX UIs.

- Policy-based controls (spend limits, whitelists) that users configure—not the exchange.

In-Depth Reviews of Our Top Picks

Gemini — Best for Security & Regulation

Gemini takes a safety-first approach with a strong compliance posture and clear security messaging. It’s a steady choice if you value governance and transparency over having every possible coin.

Pros

- Security-focused mindset

- Clear documentation and disclosures

- Clean apps and straightforward UX

Cons

- Smaller coin list than some rivals

- Feature rollouts can be conservative

- Fees can be higher on “simple” buys vs advanced trading

Coinbase — Best for Beginners & Ecosystem

Coinbase is the easiest on-ramp for most US and EU beginners, with a familiar app and a path to “Advanced” trading when you want lower, posted fees.

Pros

- Super easy onboarding and navigation

- Good liquidity on major pairs

- “Advanced” trade route with posted maker/taker fees

Cons

- Simple buys can cost more due to spread

- Feature availability varies by region

- Support queues can be slow at peak times

Kraken (Pro) — Best for Low Fees & Active Traders

Kraken Pro is built for active traders who care about tight execution, solid APIs, and a dependable pro interface.

Pros

- Competitive, transparent maker/taker schedule

- Strong depth on BTC/ETH and major pairs

- Robust tools and API access

Cons

- Interface can feel dense for newcomers

- Some products vary by jurisdiction

- Fewer “learn & earn” style features

Crypto.com — Best Mobile & Rewards

Crypto.com leans mobile-first with a broad product lineup and frequent app improvements. Rewards and promos are a draw if you like an all-in-one app.

Pros

- Polished mobile experience

- Wide product surface (region-dependent)

- Rewards and promos can offset costs

Cons

- Availability of certain features varies by country/state

- Rewards/tiers change over time—read the fine print

- Spread can vary on less liquid pairs

Binance.US — Best US Altcoin Variety

Binance.US emphasizes low fees and a broader list of US-permitted pairs than many domestic competitors. Check state availability before you fund.

Pros

- Very competitive fees on select pairs

- Solid liquidity on popular markets

- VIP tiers for active traders

Cons

- Availability and features vary by state

- Narrower product set than the global site

- Fewer educational and auxiliary features than some rivals

Frequentlyy Asked Questions

How do I recover my account if I lose my phone/2FA—and what proofs will I need?

Use backup codes if you saved them.

Start the exchange’s 2FA reset; expect ID + selfie.

Be ready with recent tx details (amounts, hashes, funding method).

Can I add a beneficiary or set up an estate plan for my exchange accounts and wallets?

Some exchanges let you name a beneficiary.

Otherwise: use a will/trust and a sealed instruction letter.

For self-custody, document seed/passphrase storage (consider multisig).

What’s the safest way to bridge assets between chains, and what risks should I watch?

Safest: CEX in→out on different networks, or the official bridge.

Test with a small amount; verify token contract/chain.

Watch for bridge hacks, wrapped-asset depegs, and phishing.

What’s the process if my account is flagged for AML reviews or withdrawals are temporarily held?

Provide KYC refresh + source-of-funds docs (statements, tx hashes).

Reply in one ticket with a clear timeline of funds.

Ask about canceling/expediting a withdrawal; don’t “hop” funds elsewhere.

How do I move from an exchange to a hardware wallet without exposing my xpub or address path?

Generate a new receive address; verify on device.

Send a test, then the full amount.

Never share xpubs; avoid reusing addresses.

What are good ways to track portfolio and cost basis across multiple exchanges and wallets?

Export CSVs regularly; tag internal transfers.

Use read-only API keys (IP-allowlisted).

Pick a cost-basis method and stick to it; snapshot year-end balances.

Conclusion

The best crypto exchange is the one that aligns with your real-world needs: where you’re eligible, what fees you can maximize savings on, and whether you prefer convenience or control.

Exchanges are tools for trading, earning rewards, and quick on/off ramps. Your digital wallet or hardware wallet is still where long-term holdings belong.